LEAD WITH VISION.

GROW WITH PURPOSE.

We work with business owners and their leadership teams to build

businesses with purpose that outlive the current generation of owners.

-

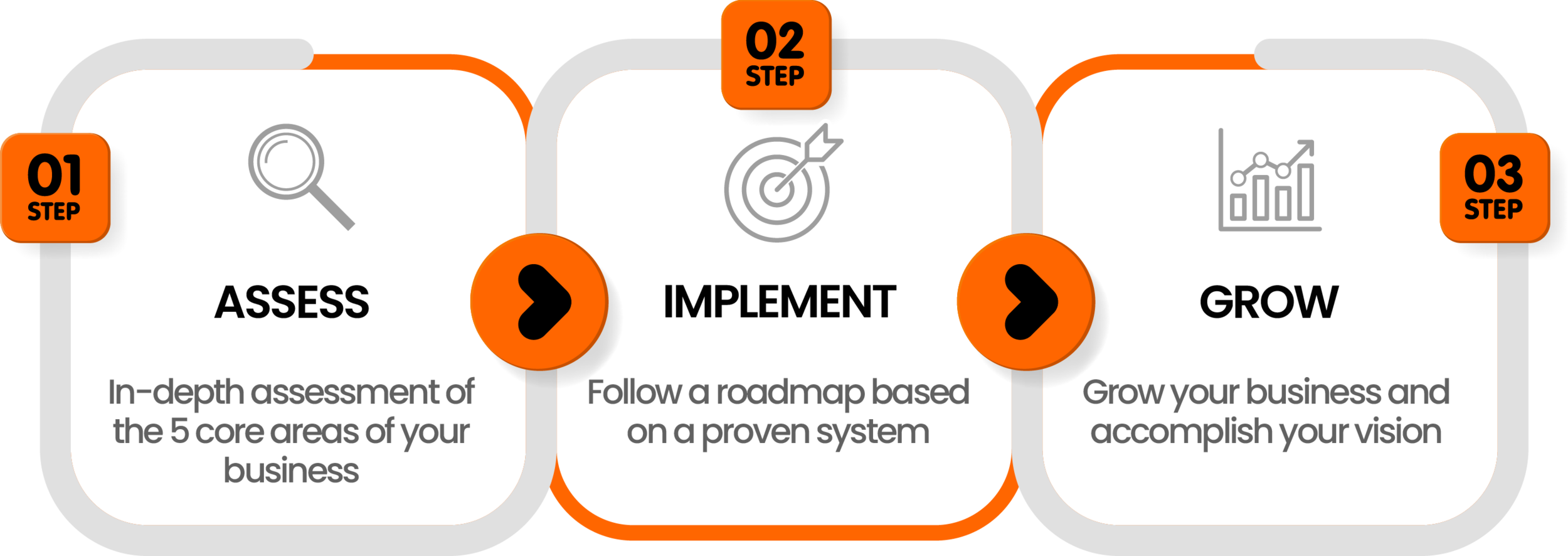

Strategic Planning

We work with you and your leadership team to design a roadmap to accomplish your Vision

-

Execution

We then teach our proven system for getting your entire team focused and consistently executing

-

Coaching

We offer Leadership Coaching and Development to grow you and your team to the highest potential

Free Download:

Grow With Purpose: Building a Mission-Driven Business (Chapters 9 & 10 - PDF’s) by our CEO, Joey Brannon

No spam ever. We will not sell your information.

Doug Poll,

Founder of Developing People Group and C12 Group Chair

“I don’t enjoy typically looking at spreadsheets and spending time pouring through data, but for me to have a resource now like Axiom, where as a business owner I can say, here is a company I trust.”

Grow Your business

and Find the Freedom

You Want

Our proven system addresses the 5 core areas of your business, getting your entire team laser-focused, whether you’re there or not.

Create predictable growth

Where your employees find fulfillment, and

Your business makes a significant impact in your community

Savannah Francis,

Founder of Elite Property Research

“I did everything, I mean literally everything…. working with Axiom really helped me to learn how to let some of it go... I don’t want to say ‘hands off’ because that’s really not what it is. I’m still involved 100%, but I don’t have to be there every day. I can walk away and know that we’ve got certain people in certain places, and the only time when I really need to get my hands dirty and get involved is when it’s a high level situation that I need to approve.”

Hear From More Clients…

Our Process

Some clients we have worked with…

Contact us

Have a question or want to discuss further? Feel free to drop us a note and we will follow up.